Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

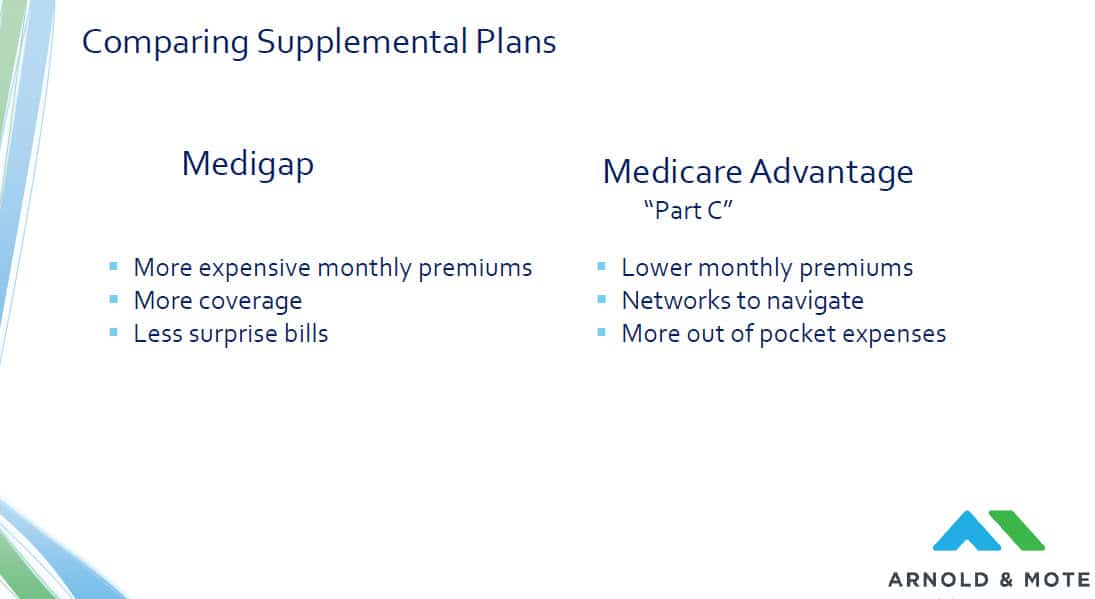

Medigap (like Plan G) costs more upfront but offers broad coverage, fewer copays, and nationwide access to providers, making it more predictable and protective when health issues arise.

Medicare Advantage may look cheaper with $0 premiums, but restrictive networks, higher out-of-pocket costs, and limited prescription or vision coverage can make it more expensive if you need care.

Switching later isn’t guaranteed, since Medigap plans can deny coverage outside initial enrollment, so choosing the right policy at 65 is a critical long-term decision.

Choosing between Medicare Advantage and Medigap insurance is a big decision that every retiree has to make. If you are near age 65, you have likely been bombarded with mailers from insurance companies offering $0 Medicare Advantage plans. What’s the catch with these policies, and how do these more affordable options compare to Medigap plans.

Below is the recording and transcript of a webinar we did for clients on this topic. We compare Medigap Plan G with a popular Medicare Advantage plan to see the differences.

Transcript and images below:

Why is this an issue at all? And what exactly are we talking about here?

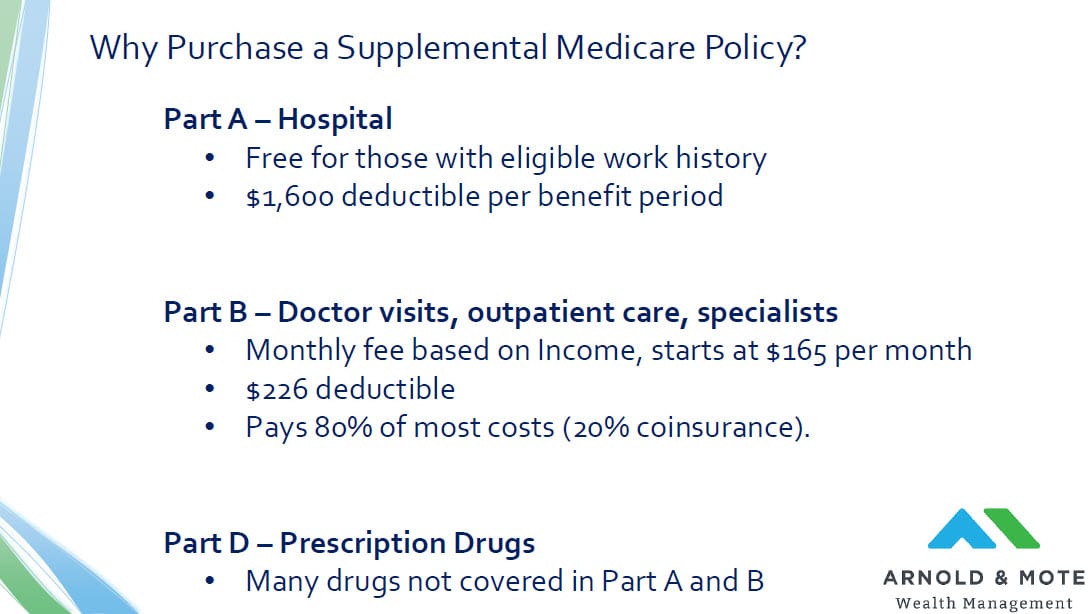

These supplemental Medicare policies we are talking about are created to serve a very important need in retiree healthcare. Just to start and make sure everyone’s on the same page here’s how these supplemental plans fit in with the rest of Medicare. Supplemental policies are made to fit on top of or with these other parts of Medicare.

Part A is your general coverage for hospitalization. It is free if you have worked and paid into the Medicare system for a certain number of years, otherwise it can be as much as $500 per month. Part A also has a $1,600 deductible. And it is not an annual deductible, but instead per benefit period which can be a little complicated but is effectively per hospital stay if there is a certain period of time between stays. So if you are in the hospital, then are home for 60 days and go back to the hospital, you can actually have 2 separate $1,600 deductibles.

That’s part A, Part B then is the non-hospital parts of your medical care. Think of things like doctor visits, outpatient procedures, and so on. Part B has a monthly premium that changes every year, but is about $165 for 2023.

Part B on its own has a small deductible that again can change every year but is currently $226.

You can use only Parts A and B for Medicare coverage in retirement. And you can see it would be fairly cheap insurance, just $165 per month for this year.

But, having just Parts A and B leaves some big gaps in coverage. The bigger risk with Part B is that it only pays for 80% of your eligible medical expenses. That’s a significant sum, but with today’s medical costs, 20% of a bill can still be significant.

I did a quick search of the costs of certain medical procedures, and the costs of course can vary drastically, but it is normal to have a heart surgery procedure that can cost $100,000 or more, and so you can see that with just parts A and B, you could still be on the hook for more than $20,000 in this example.

Then of course, there’s prescription drugs too, most of which are not covered by Parts A and B.

So, supplemental Medicare policies exist to fill this gap left by Parts A and B. It is insurance that sits on top of Parts A and B to protect you mainly from that 20% coinsurance risk, and prescription drugs.

Medicare Advantage or Medigap? Comparing Your Options

If you are like most retirees, you think about that 20% gap in insurance coverage and immediately see the value of a supplemental policy to protect you from these surprise bills.

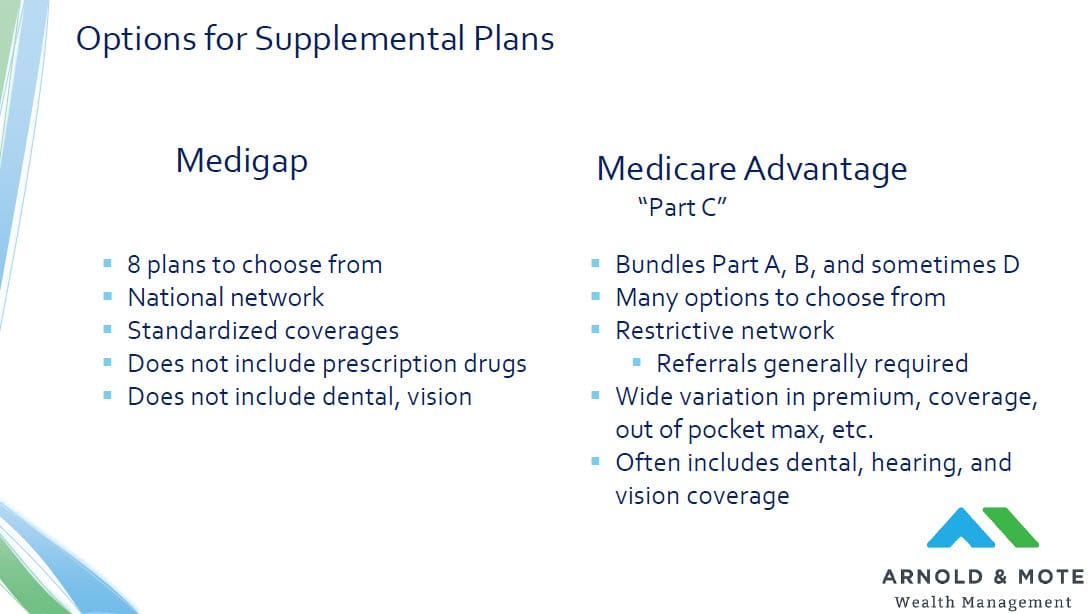

And if you are looking to purchase a supplemental plan, you have 2 main choices, and this is what our webinar is really about today – Medigap supplement plans, or Medicare Advantage which is sometimes called Medicare Part C.

These are very different options, and were going to go through a lot of slides to compare examples of these policies side by side. But as a very general comparison here’s the main differences at a very high level.

Medigap policies are very standardized. There are 8 different Medigap options for those new to Medicare today, and they each are identified with a letter. So for example, you have Plan G.

Every insurance company can sell a Plan G Medigap plan. You can buy a Plan G from Humana, or Wellmark, or Transamerica. And no matter who you buy a Plan G policy from, it must have certain minimum coverage amounts. Transamerica can not sell you a Plan G that has a $500 deductible, it must be $226, as an example. When you buy a Medigap policy, you know what you are getting with relatively little research.

That is not the case with Medicare Advantage. There are some very general minimums established, but these policies will have vastly different deductibles, copays, coinsurance amounts, and out of pocket maxes.

Another difference – Medigap policies have a huge advantage in that there is hardly any in or out of network care providers. If the doctor accepts Medicare, your Medigap policy will pay.

Medicare Advantage has much more restrictive networks. We are going to look at an example in a minute, but if you like certain doctors or hospitals, you want to be really careful at least to find a policy that is in network with your desired care provider. And this is also a big potential problem for those that travel frequently. Because if you need care outside of your local network, you could be paying extra.

And besides the restrictive networks, you generally need to have referrals to visit any kind of specialists. That means more visits, and potentially more copays as we’ll look into in a second.

And lastly, Medicare Advantage is commonly thought of as an all-in-one solution to Medicare coverage. When you buy an Advantage policy, it will probably bundle your every single aspect of your health insurance need. It will include prescription, Parts A and B, and vision, dental, and maybe even hearing.

That is not the same with Medigap. If you buy a Medigap policy, you will need to buy a separate prescription drug policy, a separate dental policy, and so on.

So, which one of these is best for you?

Well if you are like most retires you try and do some research. And what will you find?

You probably come across a lot of ads, with big name celebrities touting Medicare Advantage plans.

And these are inevitably going to focus on one specific thing – 0 cost Medicare Advantage plans available for you.

No premium, no deductibles, no copays. At the very least, these are going to get your attention.

And if the ads don’t get you – The mailings might. As you get close to age 65, you will be bombarded with ads like this.

And again, they are going to focus on that one primary sales pitch for Medicare Advantage plans – The $0 per month cost.

Nearly 50% of Medicare enrollees are in a $0 monthly premium Advantage plan as of last year. So this is obviously a huge driver of sales.

You should be skeptical of this of course. And so everyone wants to know, what’s the fine print with the $0 monthly premiums plans, and how do they actually work.

I thought the best way to begin to show take a few of these Medicare Advantage plans, look into the details and compare side by side to a Medigap plan.

To start, I went to Medicare.gov, which makes it very easy to search for Medicare policies that are available to you, and see the details I’m going to be showing here.

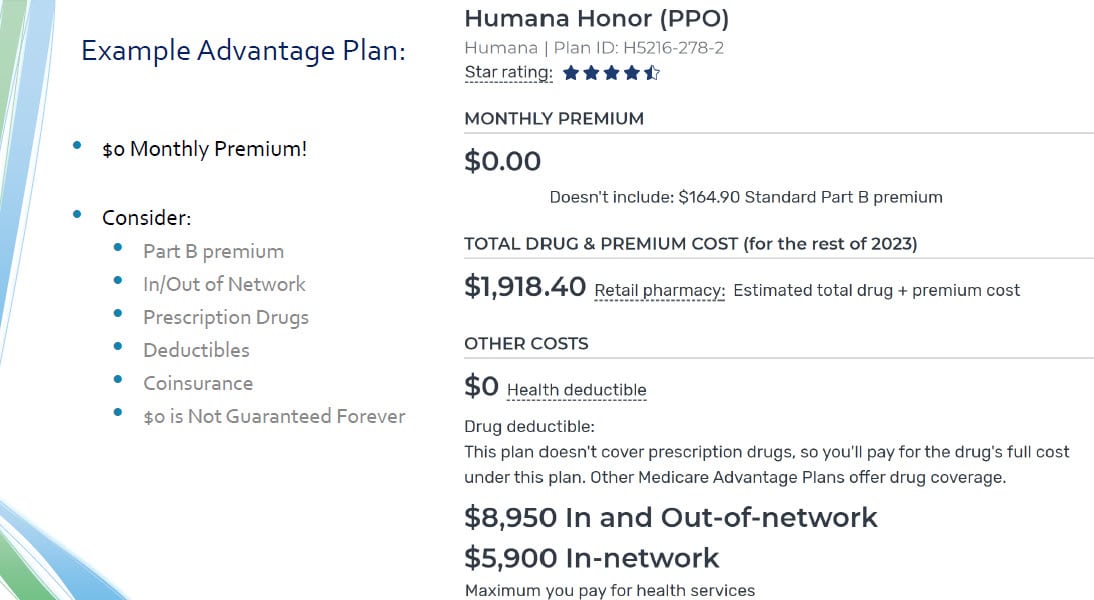

I did a search for a 65 year old male in Iowa City, Iowa, and saw this policy here as one of the 20 or so that was listed as available. It is a highly rated policy, so I don’t think I’m cherry picking a notoriously bad policy here.

Most importantly, this is one of the Advantage plans with a $0 per month premium.

Here’s a quick list of things to consider as you are reviewing these policies, and the next few slides will go into some detail on a few of these items. But a couple that can just be covered very quickly –

$0 monthly premiums does not necessarily factor in Part B’s premium of $164. I think that’s sometimes a little deceiving because Part B is so much of your Medicare coverage. So, you may still be paying that.

Also, the $0 premium may or may not include prescription drug coverage. We’re going to look into prescription drug coverage much more in more detail in a future slide.

Then, a big one – what care providers are in Network. This is a Humana Advantage policy available for purchase in Iowa City, and any University of Iowa affiliated medical providers are out of network. If that’s important to you and somewhere you’d like to go for medical care, then this may result in tons of out of network expenses and end up costing you much more in the long run. We’re going to show examples of this in just a minute.

And as a final point, there is no guarantee $0 premium lasts forever. Companies can offer $0 because of payments they receive from the government and the relatively lower costs of care with the negotiations with their small networks, and if those payments offset the cost they pay out, they can offer $0 premiums. But, if there’s a year with high costs, that $0 premium will be raised.

Plan G vs Medicare Advantage

With those general point in mind, for the next few slides we’re going to show this $0 Medicare Advantage plan side by side with Medigap Plan G, which is the most popular Medigap Supplemental plan today and also one with the most thorough coverage available.

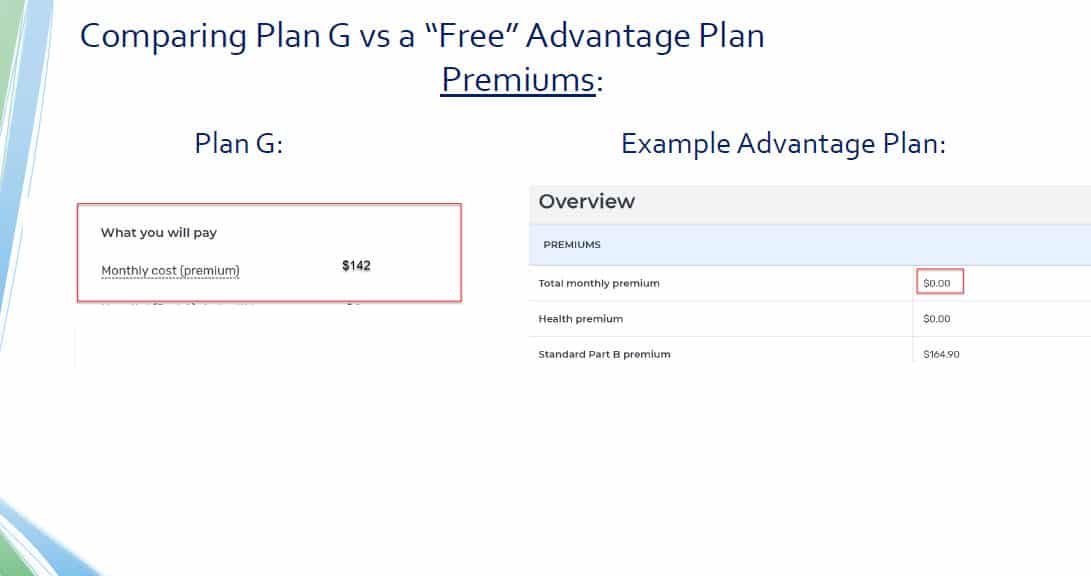

Just to start, let’s look at the premiums. As we said already, the Advantage plan is $0.

For an age 65 male, non-tobacco user, Plan G will be somewhere around $140 per month.

This is unfortunately what many people focus on. Why would you pay $140 per month, or nearly $1,800 per year, when you can get other insurance for $0?

But shopping for a health insurance policy based solely on premium is very dangerous. And we start to see why as we look deeper into these policies.

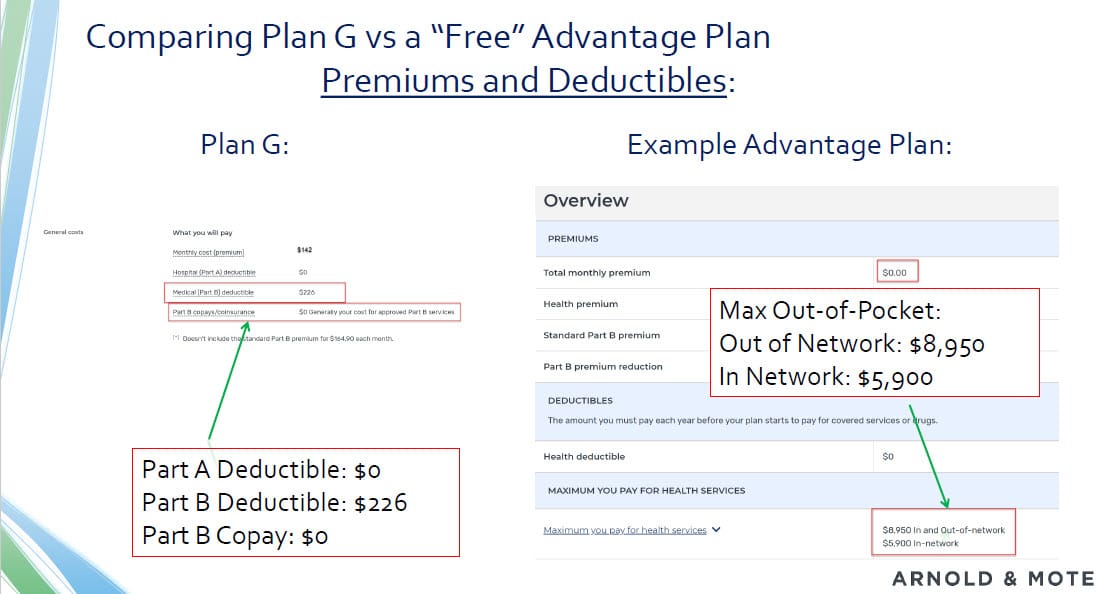

Plan G has $0 copays and 0% coinsurance for any Medicare approved expense. Those in Plan G have to meet the $226 deductible, but after that can pay nothing for any qualifying expenses.

This advantage plan has many different copay and coinsurance amounts depending on the service you need. And you can start to see how these can really add up by looking at the bottom here at the max out of pockets for this policy.

If you are out of network, it is about $9,000 per year. If you have all in network expenses it is just under $6,000.

So we are going to start seeing how if you end up needing medical care, this free Advantage plan is going to end up getting very expensive.

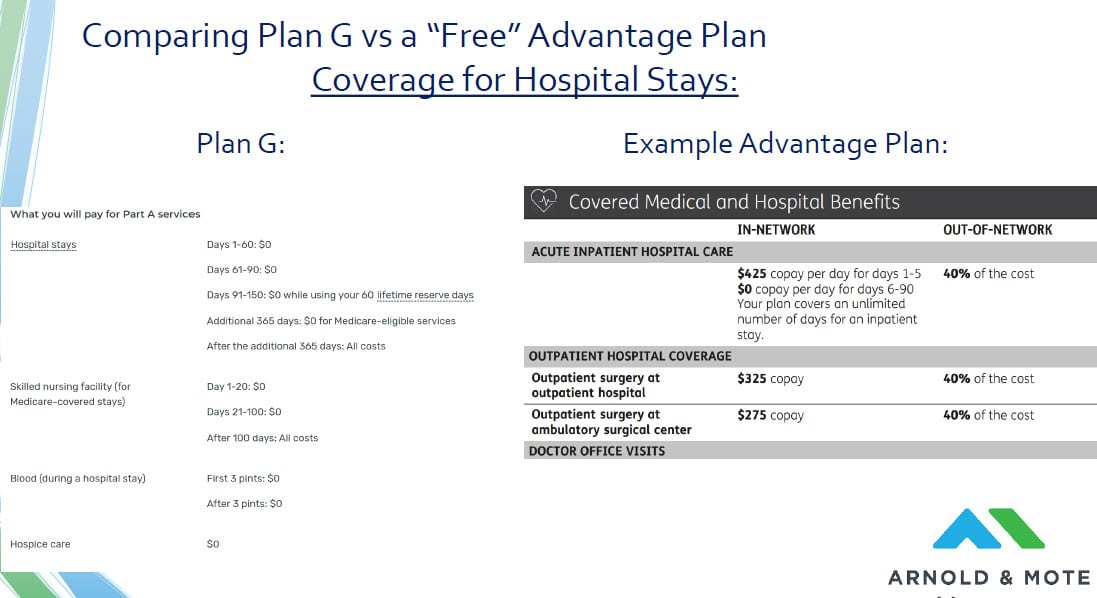

For example, let’s look at what you’ll need to pay if you end up in the hospital.

For Plan G, you pay nothing for very long hospital stays. Plan G also covers that $1,600 Part A deductible.

With this advantage plan, you’ll pay $425 per day for the first 5 days before the coverage kicks in. And that is if you are lucky to end up in an in network hospital. If not, you are on the hook for 40% of your bill.

So right away you can see that Plan G pays for itself very quickly if we have any kind of hospital stay.

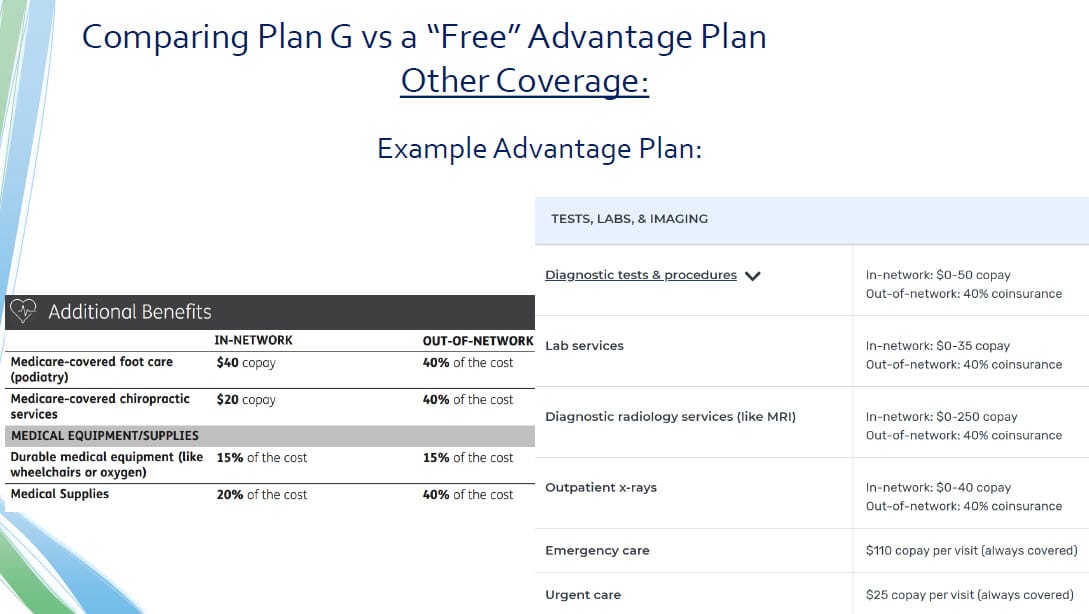

And of course hospital stays are just a part, hopefully a small part, of your medical care in retirement. But these copays exist for just about everything in the Advantage plan, any time there is a blood test needed, you get other lab work, you visit an urgent care, you need a wheelchair or an x-ray. Every time you are going to get hit with copays, and again what’s potentially very important here to note, very very large copays if you are out of network.

All of these services can be covered with a $0 copay with a Medigap supplement plan, and as long as the doctor accepts Medicare, you are in network.

So if you’re on a vacation and break a leg, with Medigap you can comfortably walk into a hospital and know you’re going to have to meet the $226 deductible and get your care covered.

With this Advantage plan, you’re potentially on the hook for 40% of your bill if there’s not an in network hospital where you are visiting.

There’s 20 pages in the plan document for this Advantage plan, and everyone’s health care needs are different obviously. But at the very least, hopefully you understand that these free Advantage plans can end up costing you more than a seemingly expensive Medigap plan in years you need medical care. At the very least, spend some time with the plan documents so you understand what you will be on the hook for, and be comfortable with that.

Medigap vs Medicare Advantage – Prescription Drugs Coverage

Another reason people are attracted to Advantage plans is they often include prescription drug coverage bundled into your other health insurance. So again a lot of people think, hey its $0 per month, and I’m getting health AND prescription drug coverage.

If I purchased a Medigap plan, I’d have to buy another prescription drug plan on top of the Medigap plan, which is only going to be more expensive. Right?

But again, you have the understand that the $0 premium is giving you much less in coverage than a policy you buy that actually has a premium. And if you actually need to start taking prescriptions anytime in your life – Its probably going to actually be cheaper to have good prescription drug coverage rather than cheap coverage.

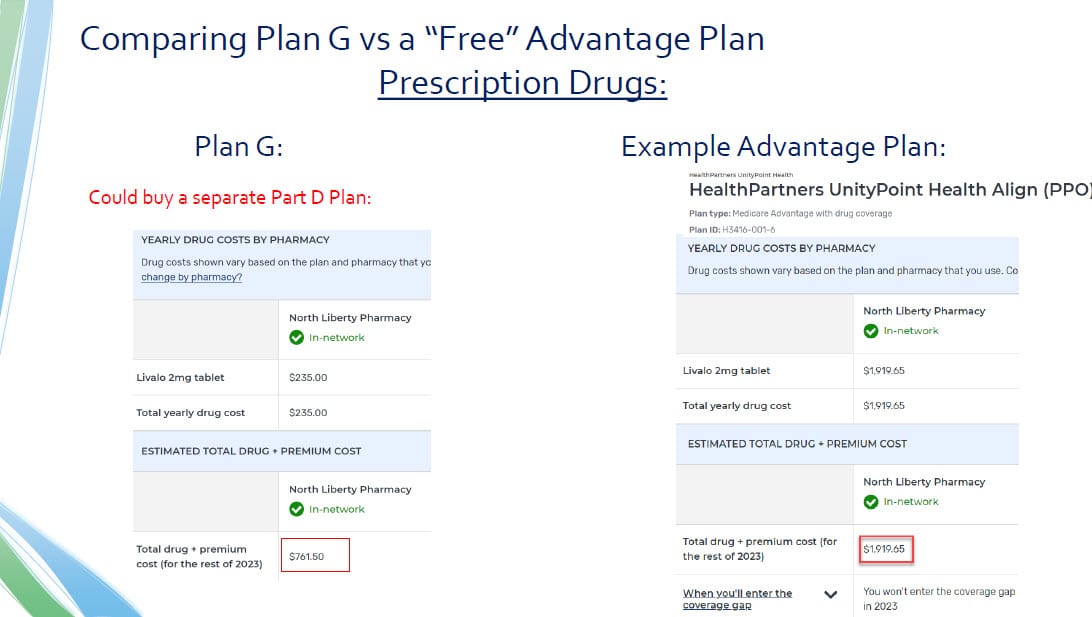

Just for example, Let’s say you get put on a statin – I typed in a certain brand of statin here, obviously costs are going to vary widely based on what kinds of drugs you are on. But on the left if the total cost that 2mg of Livalo each day would cost you with a separate prescription drug plan you can purchase in addition to your Plan G. The total cost, including insurance premiums, plus any out of pocket expenses would be $760 for this drug.

If you had selected a $0 Medicare Advantage plan, you may get much less in coverage. And so looking on the right here at the cost of that same drug with an example Advantage plan – I put the name up here at the top just in case you want to follow along on the Medicare site or just check my numbers – You’d pay more than $1,900. So, that free Advantage plan ends up costing you $1,200 more than if you purchased a separate Part D prescription drug plan in addition to your Plan G in this case.

We have a separate webinar we have done just on finding Part D drug plans to supplement your Medigap plans. Its going to be too much to go into specifics on Part D also in this webinar today, but be sure to watch that – which you can find on our Youtube channel – if this is applicable to you.

But as a very quick summary, purchasing a separate Part D plan can have a lot of advantages because you can shop for Part D plans every year and find one that is best for your prescription coverage need, and not have to balance one that is also best for health insurance, and dental, and vision. When everything is bundled like this, it can make it much harder to get a policy that is best for you.

As your prescription needs change, you can much more easily change a stand alone Part D plan compared to having to shop for all new bundled Medicare Advantage plan, which as we’ll talk about in a minute, might not even be possible to do if you develop health issues.

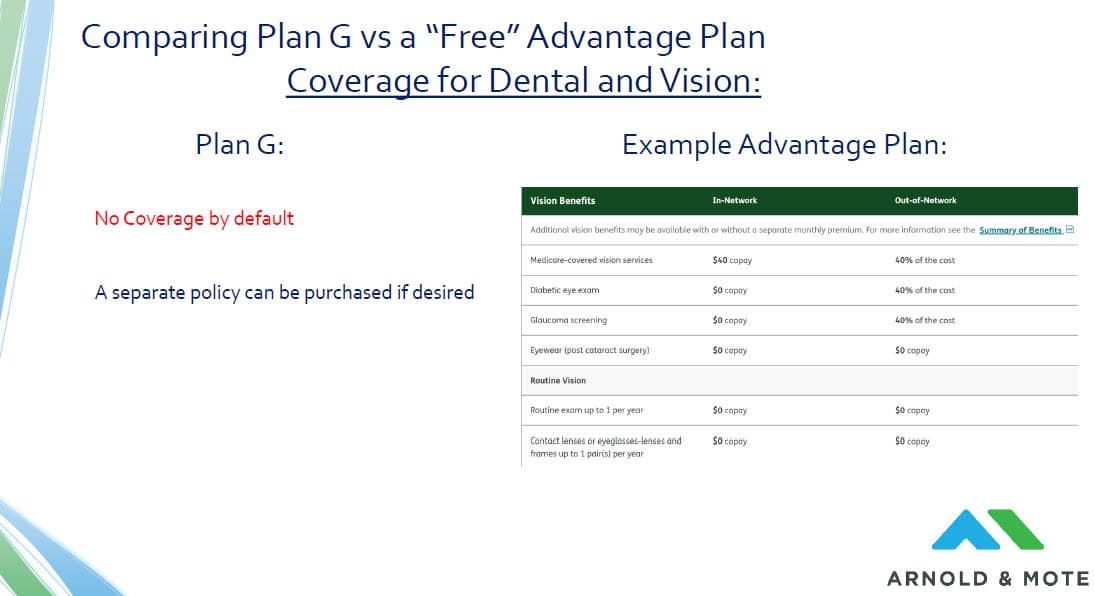

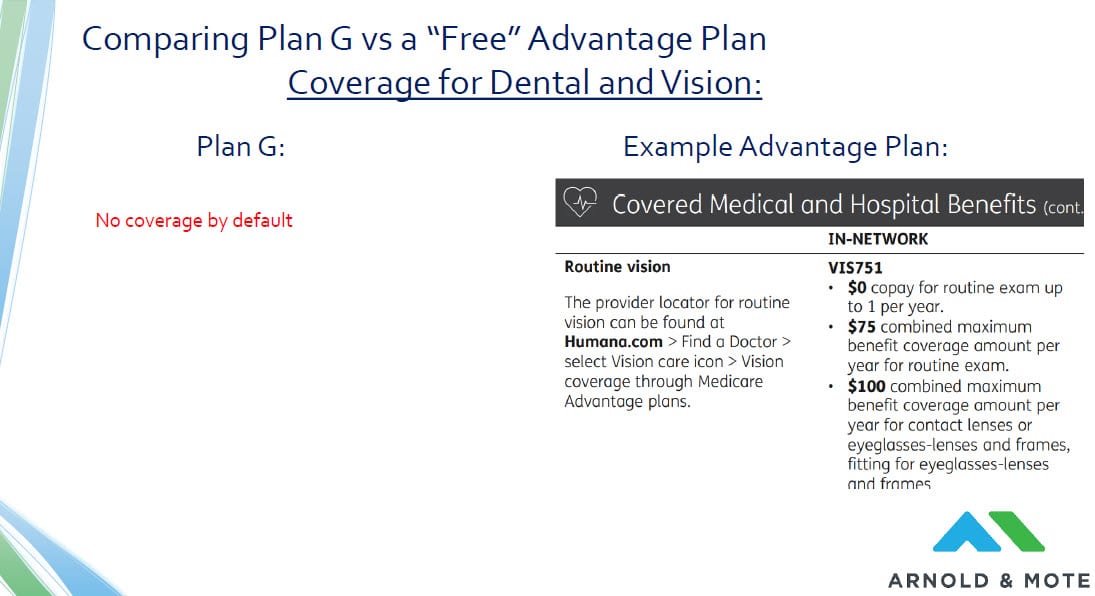

Another part of Advantage plans that seem attractive at first glance is that they include coverage for things like dental, vision, and hearing costs.

And so again, if you are on Plan G, you’d have to purchase a separate vision plan if you want vision insurance. You’d probably think, why would I pick plan G if I can get this vision coverage for seemingly free?

Well first of all – like we said before – You need to make sure you are happy with an eye doctor that is in network, because if not you’re going to have big out of pocket expenses, for this plan up to 40% of the costs if out of network.

But the bigger issue here is similar to the last few slides. The coverage that you are provided for that free price tag is just not that thorough as you might initially imagine.

For example here, all this covers you for is up to $75 for a routine eye exam each year, and a max of $100 for contacts or glasses and this is if you are in network remember. It is coverage, but will certainly still leave you with out of pocket costs.

At the very least, be sure to read these details on your Advantage policy to make sure your comfortable with the coverages, and compare to what you would pay for a separate vision insurance policy or if this insurance is needed at all.

The numbers we looked at in the last few slides are always going to vary depending on your medical needs of course.

But it can still be summarized that Plan G, or other Medigap plans in general, are going to be more expensive when you’re healthy, but they can save you significantly when you are sick and just be easier to work with not having to worry about networks.

Advantage plans will absolutely save you money when you are healthy, but when you need to use your medical insurance, you will have a lot of risks for high out of pocket expenses.

As you are deciding between these 2 options for Supplemental Medicare insurance, consider what the role of insurance is in your plan. This goes for any type of insurance really not just health insurance. You rarely want the cheapest option available, but that is what people flock to when it comes to health insurance for some reason.

But no one thinks this way when it comes to home insurance for example. You could get very cheap home insurance if all you want covered is a max of $10,000 for the value of your home. But I think we would all say that is not how you should set up your home insurance. You want protection so that if your house burns down, you don’t have to buy a new house out of pocket.

Likewise with car insurance. You probably have coverages of hundreds of thousands of dollars for various liability. Regulations aside, would you buy an auto policy that was $10 per month but only protected you for $1,000 in damages? Probably not.

Life insurance too – No one comes to us saying I want $5,000 in life insurance because its cheaper than my $500,000 policy. You purchase a level of coverage that you need to protect your family.

And that mindset should be the same for health insurance. You absolutely can get very cheap coverage, much cheaper than most Medigap policies. But when you need it, its not going to provide that same level of coverage.

So with that in mind, we tend to feel that Medigap policies just provide better protection and peace of mind making them more than worth the cost.

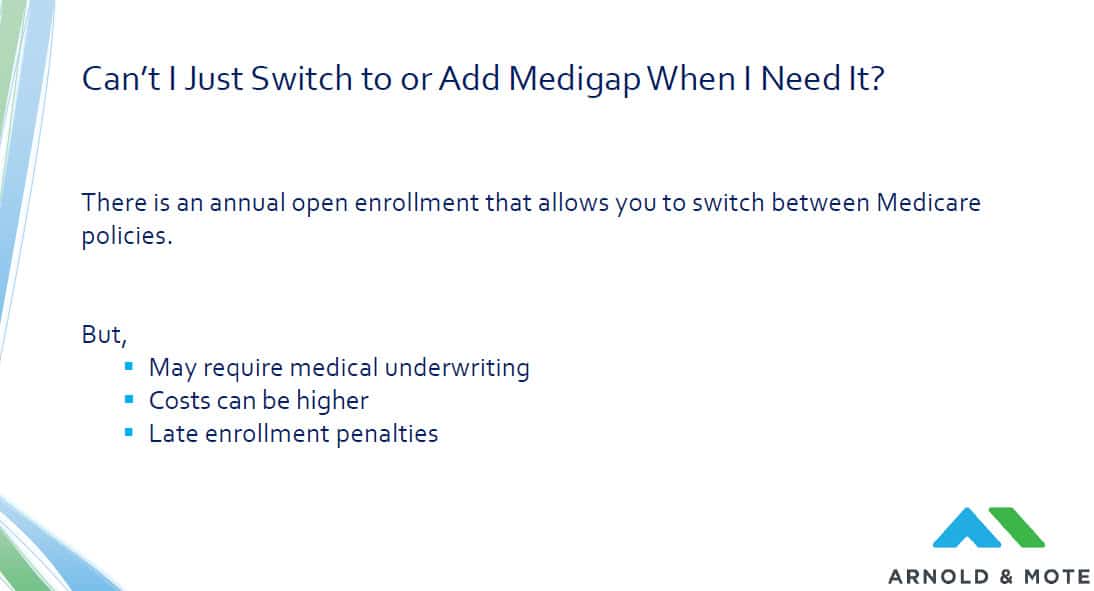

Another common question people have, or strategy they want to implement is switching to, or adding additional insurance later in your plan. Maybe stay on Medicare Advantage for 5 years, and then switching to try and save some money.

But this strategy has significant risks because outside of your initial enrollment period into Medicare, providers can underwrite you and deny you coverage based on health conditions.

And because we never know when we are going to be sick or develop any health issues, it is incredibly risky to try and stay in a cheap plan and hope you can switch over before any issues arise. Because if something does arise before you make the switch, you’re going to be stuck in your current health insurance plan and be on the hook for those expenses we looked at earlier.

Lastly, there can also be penalties for late enrollment for various supplemental policies as well, and these are penalties that you pay for the rest of your life.

This is the reason we make this a focus for our clients as you approach age 65, or whenever you are eligible to enroll in Medicare.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.