Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

We think of an Estate Planning covers 4 main topics:

Estate Planning is not usually a topic at the top of everyone’s list, but it is incredibly important.

A few common problem we see – Wills may be out of date, beneficiaries for accounts not set, or estate plans may be in place that are not tax efficient.

In this webinar we discussed some simple steps for creating and maintaining your estate plan, along with some potential pitfalls to avoid.

Below is a transcript of the webinar along with a few additional items of discussion.

We think of an Estate Plan of cover 4 main topics:

Your will, a trust (if it is required), your powers of attorney (POA) documents, and being sure you have the correct types of accounts and beneficiaries set for those accounts.

Each of these components play an important role in how your heirs inherit assets, or help you at times of need.

With that, lets lay the ground work here starting with wills.

Wills are the most basic estate planning document that allows you to outline how you wish your remaining assets after your death be distributed.

A will does 3 primary things: It directs how all of your remaining assets to be distributed. Even if you have a trust that covers some of your primary assets like investment accounts and maybe even your house or property, a will is still important to have, because there is usually still a lot of assets left over that a trust typically doesn’t cover. Maybe a car, any valuable collections, art, stamps, coins, beanie babies, or whatever you have. We’ve seen pets covered in a will, and a will can be important for leaving money to charity at the end of your plan.

Next, a will assigns an executor to oversee the disbursement of your assets. This person will work with the courts to oversee the transfer of the assets and then the disbursement.

And lastly, applicable to some – it sets guardianship for any minor children or dependents. If you have minors you are responsible for, this is a critical part of your will.

Just for a general benchmark, we think a good lawyer in our area will probably charge somewhere around $500 to draft a will and powers of attorney. And we think in general that is a good investment compared to an online boiler plate option that would cost less.

So while wills have some positives in that they are cheap and relatively simple and straight forward. But, wills have a few downsides as well that make other things like trust better options for some.

A few potential issues that could arise with a will:

Assets transferred through a will go through probate, which is the process that a court uses to prove the assets are going to who is the rightful owner. This means that wills can be contested.

So, if you make a change in your will later in life to give assets to a certain person or charity over another, someone can challenge in court that you were not of sound mind, or that you were tricked, or even that the change was forged. And while we would hope the ruling would come out in the correct verdict, there’s no guarantee.

If there is potential for a lot of hostility around your assets at the end of your plan, a will may not do what you intended it to do.

And even without problems like that, probate can just be a long administrative process with some fees as well. It can take many months or even a year to get everything settled and transferred, and if you know that certain beneficiaries will need money quickly if you should pass, you will want to make other arrangements besides all of your assets going through your will and probate.

And lastly an issue for some, the assets that get transferred through probate and a will is public information. So, there are some potential privacy concerns here if you are passing a large estate to a single person, because now the whole world can know that, this person just inherited a few million dollars just for example. And it also exposes those assets to creditors now as well.

So if your assets all go through your will to a child that is deeply in debt or facing lawsuits for example, your assets are now immediately up for grabs.

Besides just the basic limitations of a will like we just talked about, we do see some common issues in wills that we review for clients.

First of all – choosing an Executor.

You want to choose someone competent to do the job. Being an executor is many hours of work over many months, and if they do the job incorrectly or unfairly there can be legal consequences. So you probably don’t want to pick someone that has a really bad relationship with one of the other beneficiaries, for example. And you don’t want to pick someone without the time or patience to do it properly.

We also see many people list all of their children as co-executors. They do this with good intentions, to make sure that all their children have a say in things. But it leads to big administrative hassles too.

For example, if you have 5 children who are all co-executors and the estate needs to do something, all 5 children are going to have to get a document notarized to authorize the action. And maybe you can start to see if these 5 children are in 5 different states for example how this becomes a huge hassle, mailing a document all around the country, each person taking time to go to a notary…it can take many weeks just for every simple sign off that needs to happen.

So, everyone’s situation is unique and we can’t give any specific advice here. But if you are worried about fighting in the family where multiple executors would be needed, it might be wise to look into trusts or other options.

Another problem is that wills do not give you any control of the assets after they are dispersed. The common situation is an 18 year old inherited millions of dollars and blowing it all before they are 20. A will can help make sure the money goes to who you want, but it will always arrive in a big lump sum and if that person is not someone who should inherit a big lump sum, a will may not be a good solution.

And lastly, wills are commonly out of date. Some common scenarios are families having more children and the will not being updated, beneficiaries have changed, and if you have moved to a different state, that can cause problems too as states have different laws regarding how assets are dealt with after death.

In an effort not to spend a ton of time talking about all the times a will or estate plan in general would become out of date and needed to be changed, we wanted to include a checklist for you that does a more thorough job in outlying a lot of common situations that may require you to update your estate plan.

This checklist was provided to those who attended our webinar. If you’d like a copy, please contact us.

As always, please reach out to us if you have questions because this is not exhaustive, but this checklist lays out some of the most common issues that will cause you to want to make changes to your will or estate planning documents.

As we saw, wills can handle a lot of the dispersing of assets, but there are scenarios where wills don’t do everything that you need. Trusts are for these more complex or customized situations.

Put simply, trusts are new legal entities that are created from legal documents, the trust documents, to hold your assets. They are managed by a trustee, whose job it is to execute on the trust documents.

There are many, many kinds of trusts, and they can be worded to do almost anything. So if you have concerns about anything regarding how your assets are distributed, talk to an estate lawyer and they can probably help you.

Trusts are valuable for some because they can remove assets from probate. This can be good for getting money distributed faster if needed, and it is also important if you are worried about privacy and the whole world not seeing the assets you are passing on.

Having assets that avoid probate is especially valuable if you own assets in multiple states. If you have houses in 2 different states for example, you would need to open probate in both of those states, which adds a lot of administrative burden and added costs.

It is also important because remember the trust is its own entity, like a separate person or business almost. So, the assets are shielded from creditors. We touched on this earlier, but this is important if the person who would be inheriting your assets could be susceptible to lawsuits or debt collections.

Next, one of the popular reasons that a lot of trusts today exist is to control how the assets are dispersed after the original owner passes. You can outline that the assets slowly come out of the trust over time. Maybe, 5% of the account is given out each year, or a quarter of it every 5 years, or whatever payout schedule you want.

This can be applicable for charitable giving, where maybe you would rather give a charity a certain amount of money per year for the foreseeable future rather than a big lump sum. Or also for your heirs, where you want to avoid lump sums being given out immediately.

But, because of the potential for complexity, trusts are generally more expensive than a will, and if changes need to be made it is going to be more expensive than simply updating a will.

As a very general benchmark, I think we see about $2,000 to create a trust. Again, it can vary widely based on what you need, but just to give you some idea on the difference in costs from a will.

While trusts are generally thought of as a permanent estate plan, there is no guarantee that laws won’t change that impact your trust documents. A lot of people create these documents and think they are set for life and it never needs to be revisited, but that is not always the case.

One big change recently that impacted a lot of those who have trusts came from the SECURE Act, which was passed at the end of last year. And now, with everything else that has gone on over the last few months, so notable changes have been glanced over or forgotten about.

The law had lots of changes, but one notable one for those with trusts was the elimination of what was called a stretch IRA. This was the required distributions from inherited IRAs. Sort of like RMDs, or required minimum distributions, the IRS required those who inherit an IRA to withdrawal a certain amount of money every year.

The “Stretch” term came from one option that an inheritor had, which was to spread out the required distribution from the IRA over their entire life. This made it so they had relatively small distributions each year.

And remember that distributions from IRA are taxable. So, if you inherit an IRA, those required distributions are taxed like income. So, if you are already high income, or take a big distribution from an IRA, you are taxed at the rate of your income tax rate.

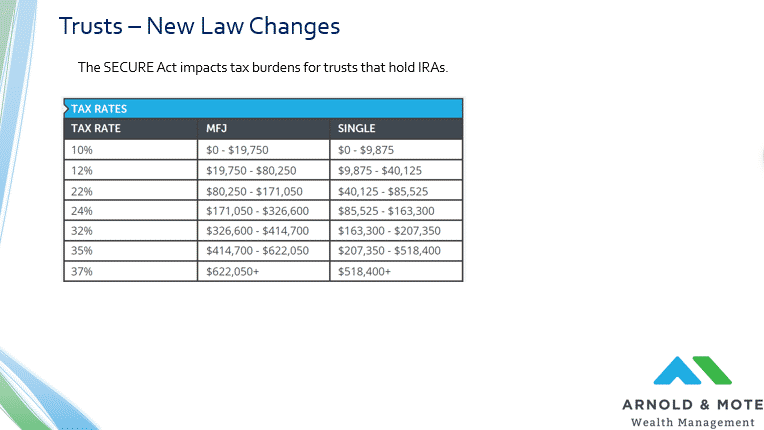

For individuals, here’s the tax rates you would be looking at. And while no one loves the idea of paying a lot in taxes, its worth noting that these rates are relatively low by historical standards, and there is a lot of room in these lower brackets that apply to a majority of the households today.

But, these brackets are very different for estates and trusts. You will see the tax rates are very high for relatively small amounts of income.

So, where does this fit in with the SECURE Act?

Prior to the SECURE Act, owners of large IRAs looking to pass wealth to younger generations may have designated a trust as beneficiary of the IRA to control how quickly IRA distributions are paid out to heirs, and also provide legal protection from potential creditors

Now, if you, or a trust, inherit an IRA, the money must be distributed from the IRA in 10 years or less. Depending on the trust documents, this distribution may be in excess of what is authorized in the trust documents, so excess IRA distributions may be taxable for the trust, and as you can see here, even relatively small distributions can be taxed very highly.

Just for example, if you wanted to leave an IRA for a grandson, but wanted the trust to slowly distribute the assets over a 20 year period – In the past you could create a trust that outlined that restriction.

But now, after the passing of the SECURE Act, that money is going to be required to come out of the IRA in 10 years or less. So, there is a problem. This person will want to talk with an estate lawyer about new options available, because their trust may now not be able to efficiently perform what they originally wanted.

So, while trusts can be a very good option for those looking for control of their assets, nothing is perfect and like individuals and households, trusts are still going to be required to adapt to any law changes in the future. Very specifically on this change, if your trust is set to own your IRA after to pass, it is worth reviewing to make sure this law does not require you to make a big change.

One note on trusts here before we move on. Trusts are a very complex issue that we are going through quickly there. Historically, say a couple decades ago, financial advisors probably spent more time talking to a larger number of their clients about trusts, because they were a common strategy to help families avoid the estate tax.

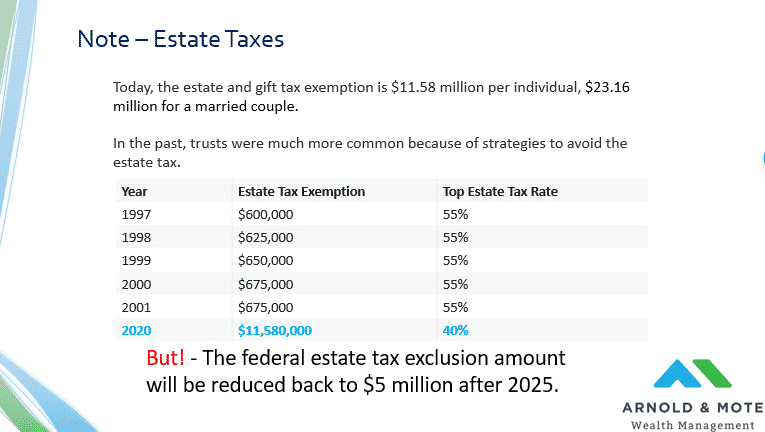

However, recently the exception to the estate tax, which is the amount of money that can be passed through an estate tax free, was raised significantly. Today, an individual can pass along more than $11 million before the estate tax comes into play, and that doubles for a married couple.

And so, we did not spend any time today talking through trust strategies that are used to avoid the estate tax. Because, Needless to say, a lot of people today do not face the likelihood of passing along more than $23 million.

However, we may soon go back to a time where this needs to become more common again. As the law is written now, the current tax law sunsets and reverts to the previous tax law beginning in 2026. If that happens, the estate tax exemption will fall.

This is something we are keeping our eyes on, and it would be good for you to know about as a possibility in the future.

So, I am saying this just to provide another example that while trusts are certainly seen as superior to wills for a lot of complex estate planning items, even trusts are not fool proof and could require changes and even a complete change of strategy is laws change in the future. Estate plans will always need to be regularly reviewed.

POAs are usually drafted when you do your will. So if you need these and your will done, they are usually knocked out at the same time.

The idea of a POA is fairly simple. They allow others to act on your behalf if you become disabled and not able to take care of yourself.

The most common uses are for allowing someone to continue to pay bills, utilities, or things like life insurance premiums to make sure those stay current even if you become disabled.

Besides financial power of attorneys, there is also health care power of attorney, which allows other to make medical care decisions on your behalf.

These are generally straightforward, but we wanted to make sure we covered them here, because as you can imagine for many people they are very important to have at very critical times.

While they can be simple, there are Some mistakes or misconceptions that we see with regard to POAs.

First of all, they have a very important need in that they cover you while you are disabled. But, once you pass they no longer function.

So, the other elements of an estate plan that we have talked about are still important because they cover what happens if you were to pass.

And like wills, we often find that these are outdated. Many spouses list each other, which is smart, but very later in life, or if there is a big age difference between you and your spouse, or just as a contingency, you may want to have alternatives set to make sure your POA will be able to execute for you if something were to happen to you or both of you.

And that limitation of POAs is where proper titling of accounts and proper setting of beneficiaries comes in.

If we manage your accounts at Schwab, we take care of this for you. But there are other accounts that you will want to make sure are set up correctly.

Bank accounts for example. You want to make sure that your spouse has access to your accounts if something where to happen to you.

And some bank accounts can also be set to automatically transfer to a beneficiary upon the owner’s death. This happens outside of probate, so it can save time and make it so bills can be immediately paid for example.

Joint tenant designation is set for brokerage accounts and property most commonly, and ensures that full ownership of the account goes to who you intend it to if you should pass.

We have brought up beneficiaries in several of our webinars now, but this is just one more reminder to make sure you have set your beneficiaries, and reviewed your beneficiaries recently.

If you have beneficiaries listed on your IRA for example, that will trump what is in your will. So, if you update your will because of changes, you want to be sure any beneficiaries are updated as well.

Besides just making sure your intent is met, there is a lot of considerations regarding taxes for example, on setting beneficiaries for different types of accounts. For example, you may want a charity or beneficiary with low income to inherit an IRA, whereas a heir or higher income beneficiary would inherit a Roth IRA for example.

And lastly, this is a bit random but very important. HSAs function very differently than other tax deferred retirement accounts if beneficiaries are not listed.

If an HSA does not list your spouse as a beneficiary, your spouse will still get the money, but only after it is withdrawn from the HSA. This can create big tax burdens for your spouse. So, beneficiaries on every account are important, but because of the IRS rules, HSAs are tremendously important to have your spouse listed.

We are not lawyers, so we can’t draft up these documents or provide legal advice.

But we can help in a number of ways. We can help create a plan for you that executes your wishes in the most efficient ways possible. And, if it saves you some hassle, both Quinn and Cindy are notaries, so they can help you with the final signatures you will need to make on the documents.

We review these documents to make sure they are written to be clear and accomplish what you want done. A lot of people give lawyers a pass I think just expecting these to be very complexly worded documents full of legalese, but it doesn’t have to be that way and it shouldn’t be that way. And this is important because you don’t understand how these documents are written, there is a good change your executor or trustee will be unclear too.

And lastly, as we discussed earlier on. As laws change, your estate planning documents may need to change too. So it helps us to know what is in your will or trust to make sure we know when or if changes will need to be made over time.

Need help with your estate plan? We’re here to help!