Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Updated February 2024 to reflect Iowa tax law changes.

Iowa municipal bonds can save Iowans a lot of money in taxes because of Iowa’s high state income tax rate. But, many investors are not investing in the right municipal bond or fund to maximize their potential tax savings.

We covered the topic briefly in one of our latest YouTube series:

This post will go into detail about how to determine if Iowa municipal bonds are right for you, and the best way to invest in Iowa municipal bonds today.

And as a warning, be cautious investing in Iowa municipal bonds that are being pushed from brokers. As a fee-only and fiduciary investment adviser, we don’t receive commissions for selling these bonds to our clients. You can be sure our advice is objective and fair.

If you are considering investing in Iowa municipal bonds, please schedule a free introductory meeting to make sure they are right for you.

Municipal bonds provide income that is not subject to income tax at the federal or the state level. But ONLY IF the municipal bonds are issued in your state.

For residents in high tax states like Iowa, investing in any one of today’s large municipal bond ETFs or mutual funds is not giving you all the tax breaks you are eligible for.

Iowans have a few extra hoops to jump through in order to invest in municipal bonds that exempt them from both federal AND state taxes. However, the extra hassle can save you thousands in taxes.

Here’s a quick review of how municipal bonds differ from other bonds, and why Iowans may not want to be investing in big municipal bond funds from Vanguard, iShares, or other large fund companies.

For Iowans specifically, municipal bonds can save investors a lot of money in taxes. Let’s take a look at an example:

Let’s compare 2 different bonds, a corporate bond and an Iowa municipal bond. First, a corporate bond from a local company, Rockwell Collins:

The bond yields 3.7% and matures in late 2023 – That means an investor who buys this bond will receive 3.7% of their investment per year until 2023.

The second bond is an Iowa municipal bond issued by the Waukee Iowa Community School District that yields 3.25%:

At first, it may appear that the Rockwell Collins bond, which yields 3.7%, would give an investor a higher income than the Waukee Iowa municipal bond, right?

For households in high tax states municipal bonds may provide higher returns than today’s corporate bonds.

Let’s say you invest $100,000 in the Rockwell Collins bond and $100,000 in the Waukee Iowa municipal bond.

For the Rockwell Collins bond — 3.7% interest on $100,000 gives you $3,700 in annual income. But at the end of the day, you don’t pocket $3,700. That’s because the interest from the Rockwell Collins corporate bond, like all corporate bonds, is taxable at the state and federal level.

First, you pay federal income tax (let’s assume you are in the 24% tax bracket). That’s $888 in taxes. Then, assume you pay 5.7%% Iowa state income tax – That’s another $211 in taxes.

In total, you receive $3,700 in income from the bond, but pay about $1,100 in taxes. A net income of just $2,600 after taxes.

We would say that this bond has an “after-tax yield” of 2.60%. That is, after you pay the taxes on the bond, you are left with an interest rate of 2.60%. That doesn’t sound nearly as good as 3.7%!

THE IOWA MUNICIPAL BOND IS MUCH MORE TAX EFFICIENT.

Remember, the municipal bond had a 3.25% yield.

If you invested that same $100,000 in our municipal bond, you would receive $3,250 in annual income.

And best of all – You pay no taxes. No 24% federal tax, no state of Iowa income tax. You keep all $3,250!

So, although this bond looked like it had a lower interest rate – an investor would be much better off buying this municipal bond than the Rockwell Collins corporate bond (Before considering any differences in credit risk!).

Municipal bonds offer a lot of benefits, but if you want to buy – where do you go?

You would think it would make sense to just search Vanguard, or any other large mutual fund company for a municipal bond fund, right?

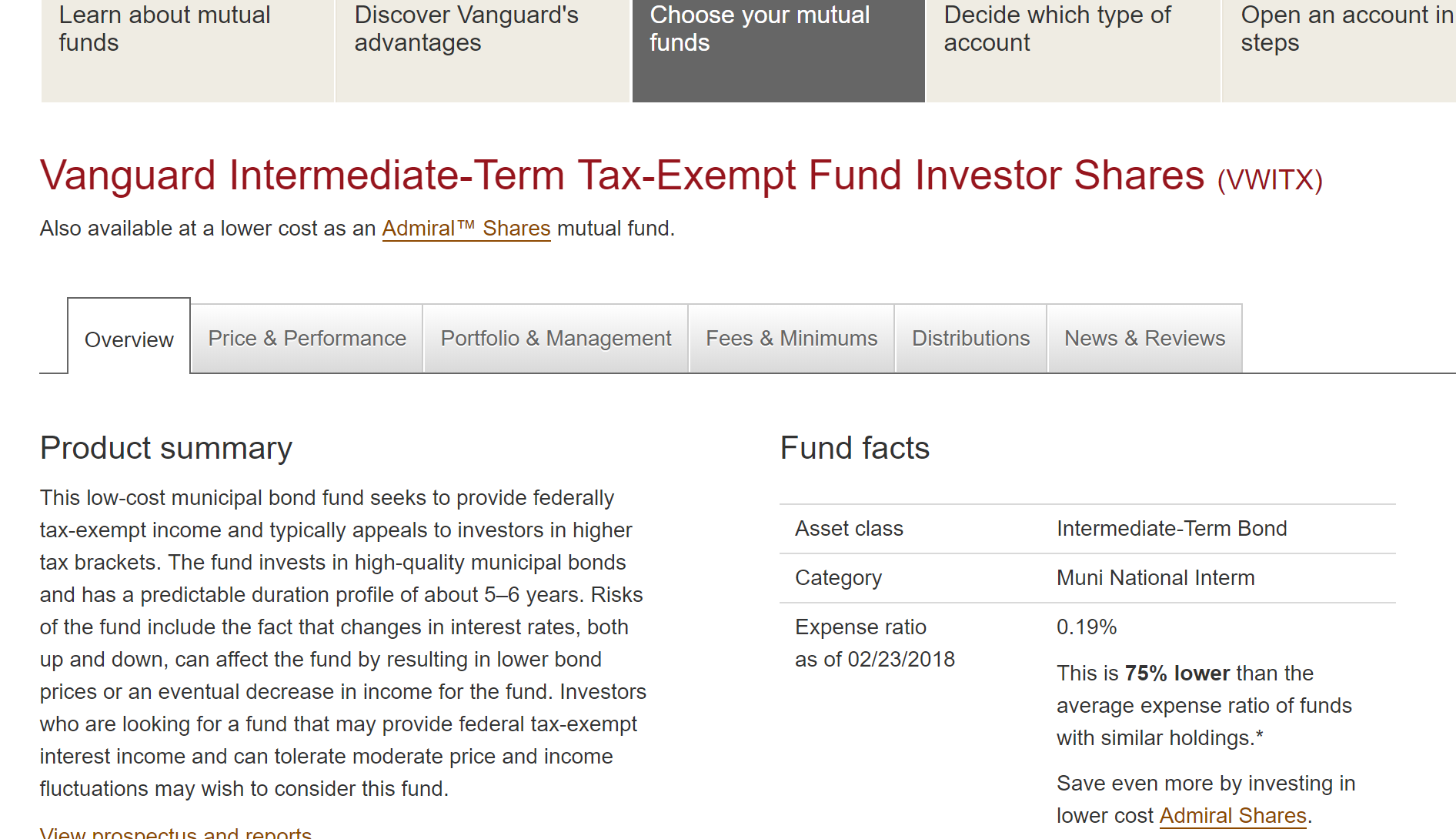

Here’s one of Vanguard’s largest municipal bond mutual funds:

But it is not that easy.

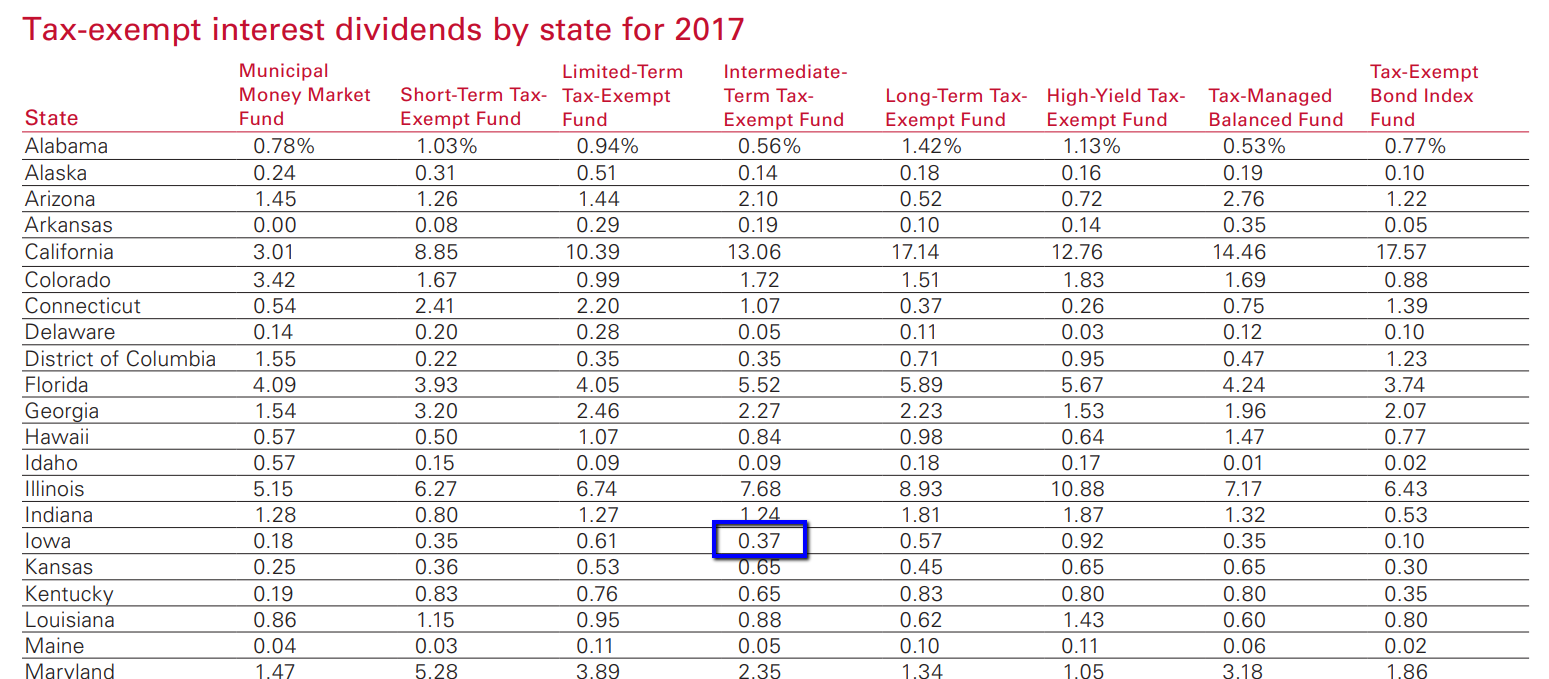

Iowans looking to invest in Iowa municipal bonds will be very disappointed, because large municipal bond funds such as this one hold very few municipal bonds from Iowa:

Remember, Iowans only get a break from state income tax for municipal bonds from Iowa. And if you read the fine print of this fund (or any other municipal bond fund), a very small portion of the fund’s income comes from Iowa municipal bonds. For this particular Vanguard Municipal bond fund, only 0.37% of your income from this fund would be eligible for a state tax break.

What does that mean for a hypothetical $100,000 investment in this Vanguard fund compared to if you had invested solely in Iowa municipal bonds?

The Vanguard fund currently yields 2.7%. That means your $100,000 investment will provide $2,700 in income per year. Although you do not have to pay federal taxes on this income, you will need to pay Iowa state income tax.

Investing in Iowa municipal bonds would save you that tax. Plus, Iowa municipal bonds today typically have higher yields than the municipal bonds from other states that make up these big municipal bond funds.

So how do you invest only in Iowa municipal bonds easily with a single mutual fund or ETF?

You can’t. There are no Iowa municipal bond funds.

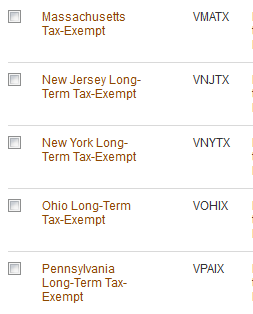

Residents of other high tax states have it easy, as there are mutual funds that invest solely in municipal bonds from their state:

But we Iowan’s aren’t that lucky. So what do we do?

Iowans are stuck investing in individual municipal bonds if they want to take full advantage of the tax breaks available. The bonds from our state that qualify for both federal and state tax breaks are typically referred to as “Iowa double tax exempt bonds”.

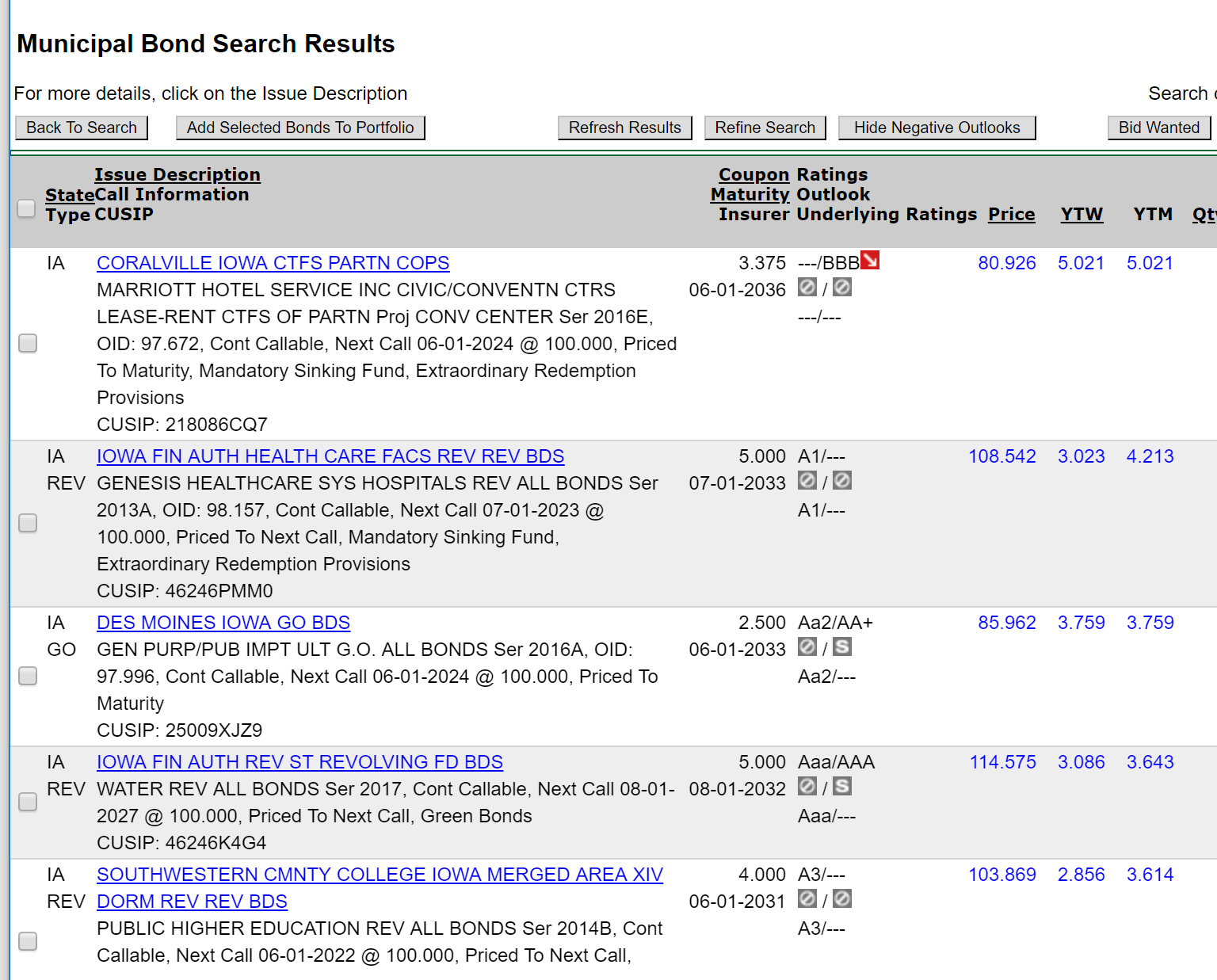

For an investor not used to investing in bonds, finding these can be complicated and intimidating. Here’s what a typical screen will look like when you search for Iowa municipal bonds:

But, to make things even more complicated, it is not as simple as just picking any bond on the list and buying it. Iowa has pretty complicated tax laws that limit what types of municipal bonds give investors a state tax break.

If you remember one thing from this post, let it be this:

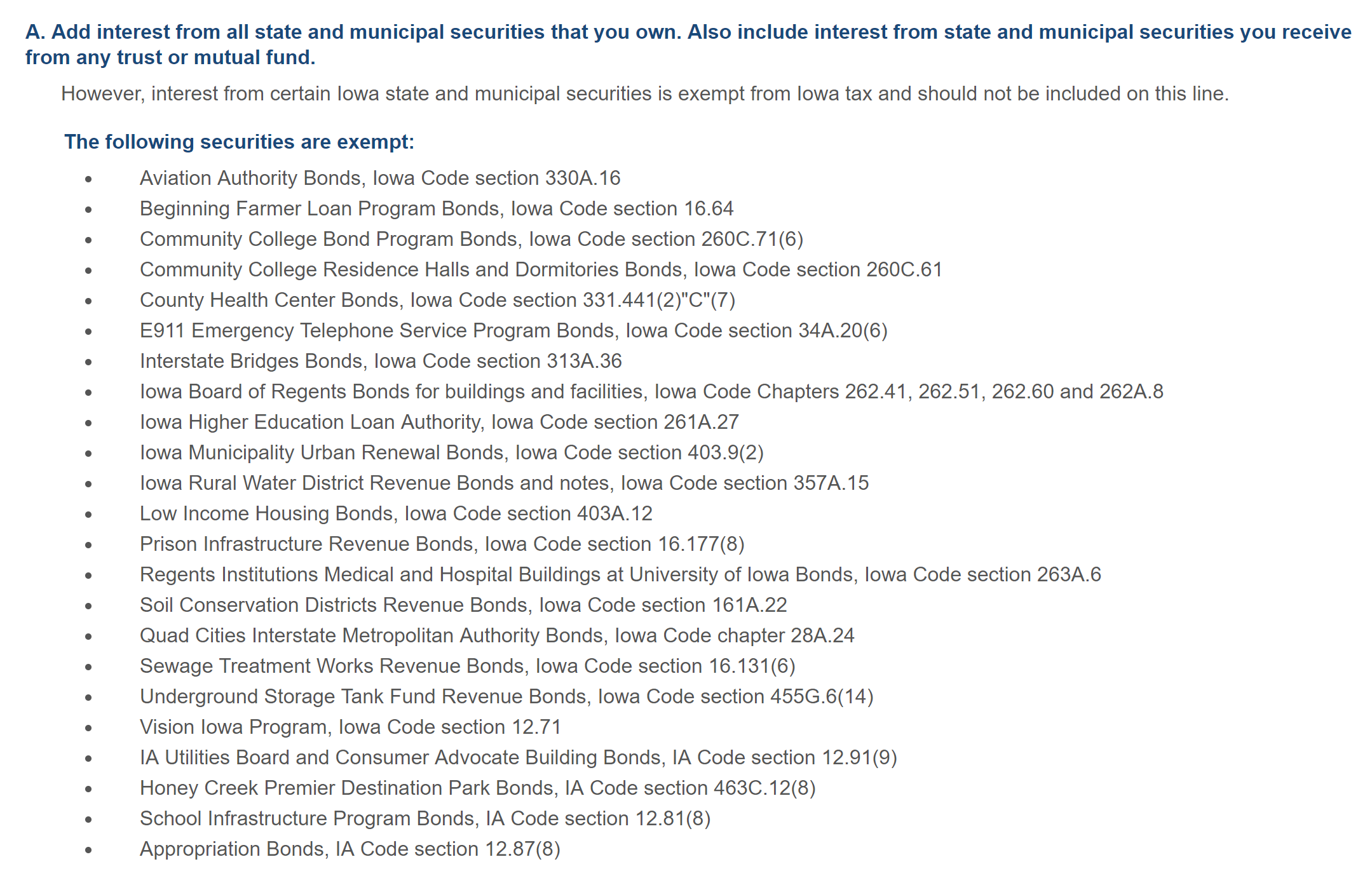

What does it take for a bond to qualify for double tax exemption? Here’s some of the specific criteria from the Iowa tax code:

So, you need to go through each of the bonds available to you and verify that they meet one of the exemptions above to qualify for the Iowa state tax exemption.

(Or, contact us and let us do the work for you!)

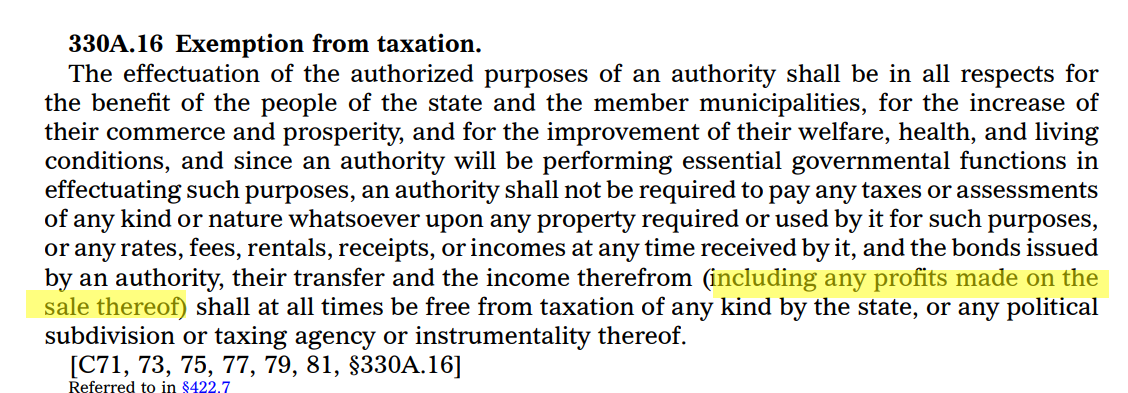

One of several unique benefits available for those who delve into the details of Iowa’s municipal bonds is identifying a few types of the bonds listed above that provide not only tax free income, but also tax free capital gains – which is very rare for municipal bonds and certainly does not come with municipal bond funds.

What does this mean? Certain municipal bonds may be better than others for certain scenarios. Knowing what types of Iowa municipal bonds are best can save you additional money from taxes.

For example, in a period rising interest rates, Iowa municipal bonds may be trading below their par value (typically $100). IF you can find certain municipal bonds that not only provide tax free income but also tax free gains – those bonds currently priced below par may provide higher after-tax returns than other municipal bonds.

Not sure if municipal bonds are right for you? Not sure how to choose the right municipal bonds?

Arnold and Mote Wealth Management is a Flat Fee (no % of asset fee!), Fiduciary, Fee-Only investment advisory firm based in Hiawatha Iowa, and serving clients across the state (and country). We offer holistic financial planning and investment advice – Municipal bonds are just a small part of what we do.

Ready to see what we can do for you? Let us know how we can help you.